Published on

Financial Modeling for Your Online Product Mix Beyond the Fall Term

In a previous article, I discussed how financial modeling work could be adapted to inform decision-making and understand the financial implications of continuing the fall 2020 term online. Since financial modeling is complex and must be accomplished over multiple iterations, institutions simply will not be able to address all the strategic and financial questions raised for the fall term in time. Instead, I recommended that they prioritize the inputs that will have the biggest impacts on the financial model (and be prepared to change priorities if, within the allotted time an unexpected significant input is discovered).

Almost all colleges and universities had initiated some level of activity around online education before the COVID-19 crisis struck. The rapid switch to remote learning necessitated by the pandemic was a departure from a strategic approach to developing an online initiative. Institutions have an opportunity, as they begin planning for fall, to use their efforts as the foundation for getting their online initiatives back on track. In this article, I discuss how institutions can start developing a longer term, more comprehensive financial model for online education initiatives, beyond what may be needed for the fall term.

Align online initiatives with institutional goals

Financial modeling will be accelerated if the online work at an institution has been structured to align with the institution’s overall strategic plan. That isn’t always the case; sometimes institutional strategic plans include nothing about online education, but usually a connection can be made somewhere.

Integrating online learning as thoroughly as possible into the strategic plan’s trajectory helps ensure that everyone is working in the same direction. Because of the many decisions and assumptions needed to build a comprehensive financial model for online initiatives, the modeling itself is an exceptionally useful tool to assess current organizational status and structure. Financial modeling provides insight into the many processes that make exceptional online education possible, identifying what is strong, weak or completely missing. This insight can in turn help the institution identify issues that slow progress on the overall strategic plan.

Determine scope of academic product mix

For almost every institution, the online product mix will include much more than one course or program. Colleges and universities would do well to determine strategically what the scope of their online product mix will eventually comprise, as informed by their strategic plan. After the current crisis, does the institution want to develop one or two online programs? Does it want to provide undergraduate students with an online modality choice across multiple courses? Does it want to create an additional, sustainable revenue stream with online graduate programs? Does it want to use an online program manager (OPM) or does it want to create internal OPM-like capabilities?

These questions should not be answered unilaterally; instead, they should be integrated into the financial modeling process. Because financial modeling provides so much insight into the full landscape of an institution’s online activity and capabilities, a best practice is to develop financial modeling and online strategy simultaneously to produce the strongest, most transparent and accurate results. Finance and strategy should be intertwined.

As your planning team seeks to comprehensively model different program options from different schools or units, consider creating “buckets” of similar product types. As is often the case, scale and simplicity equal success. Creating a new model for each course or certificate will mire down planners in an unmanageable morass of customized functions. Product buckets provide a balance between specificity and manageability. For example, your online academic product mix might include master’s degrees (one bucket) and certificates of either 40 or 80 contact hours (one bucket each). Choose product buckets that work best for your situation; with time and experience, you can make changes as needed.

Model the timing and financial implications of new program launches

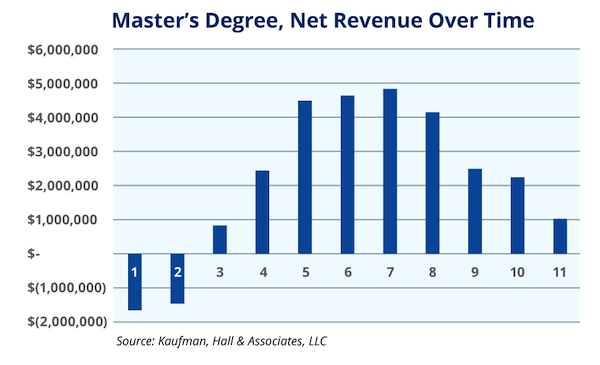

For many institutions, a comprehensive online initiative will be introduced in phases, as successful programs provide additional resources to fund new programs. A company like Apple, for example, has gradually grown its product line, with successful products producing a sustainable cash flow and providing support for new innovations until they become self-sustaining (the iPhone) or are retired (the Apple Newton). For online programs, it is the same: new product launches, in general, will require three years to become revenue positive–as shown in the graphic–and will require both initial funding and support until they produce a positive margin.

Given the financial necessities of late, with overall enrollment numbers less certain ongoing, it’s more essential than ever for institutions to do more with less. The availability of funding for high-profile product launches may be low. Although starting a new program or academic course of any kind will require financial outflow—an investment, similar to venture capital, that investment could be formed in multiple ways, some other than dollars. For example, quickly produced, remote course curriculum could be efficiently re-produced for ongoing online learning by faculty with the help of instructional designers. This kind of thinking and action could lead to both product and process innovation.

Additionally, given uncertainties over the possibilities of in-person education ongoing, some institutions will desire a hybrid approach to a majority of their course offerings because of its additional flexibility. This approach is beyond the scope of this writing but will also require extensive financial modeling for a clear picture of its impacts.

For modeling, the speed of product launches must be considered and informed by the amount and type of investment. Initial investment in various forms will have to be supported until the academic product mix becomes sufficiently robust to support itself, and ultimately fund the development of additional programs. Success breeds success (and can cover the cost of an occasional misstep). Again, financial considerations and strategy must be intertwined.

The timing of online product launches is an essential input as your planning team models how many online programs the institution can support and establishes expectations about sustainable cash flows with your institutional leadership.

Build your knowledge

As I have mentioned several times in this article, strategic planning and financial modeling for online initiatives must be developed interactively and aligned with the institution’s overall strategic plan. Strategic direction will inform financial modeling decisions; financial modeling will inform how and when programs are launched, and which have the greatest potential for success. Working backward from all that learning, you will be able to create or modify the processes that support these plans and construct a dynamic structure for how to integrate them throughout the institution.

These activities require a significant amount of time and knowledge, spanning a wide array of functional areas, including strategy, finance, academics, pedagogy and course design. Consider bringing in an outside team that can help you develop strategy, models, and processes. This proactive choice can save a considerable amount of resources and time, build expertise internally and provide a space to hold internal politics at a distance. All these efforts encourage success.

If you have comments or questions about this article, please contact Larenda Mielke by email (lmielke@kaufmanhall.com) or phone at (224) 724-3458.

Author Perspective: Administrator