Published on

Is Tuition to Blame for Rising Student Debt in the United States?

The following interview is with Sandy Baum, research professor at the George Washington University Graduate School of Education and senior fellow at the Urban Institute. Baum has done a great deal of work around higher education affordability in the United States and, in this interview, shares her thoughts on the issues caused by constantly rising tuition and the impact it has on student enrollments and success.

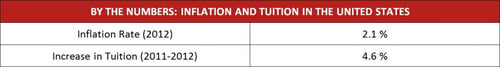

1. For more than a decade, tuition rates at American colleges and universities have increased at a higher rate than inflation. What are some of the most significant problems with this trend?

Published tuition prices have been rising faster than overall inflation for much longer than a decade. It’s first important to remember that the Consumer Price Index (CPI) is an average, and about half the prices of individual goods and services rise faster than the CPI and about half rise more slowly. Think about the goods that have become much cheaper — primarily, computers and other technology-based items. They bring the CPI down. But there is no reason to think that our ability to produce those goods more cheaply will put much downward pressure on the cost of producing a college education. In fact, colleges now have to provide all kinds of fancy technological items they didn’t have to worry about a decade ago.

Colleges could certainly do more to increase efficiency and cut costs. But the reality is the rapidly rising prices, at least outside of private research universities, are not really explained by rising costs of production. In fact, the cost of educating students in most public four-year colleges has risen just slightly faster than the CPI over the past decade. The problem is much of the cost used to be covered by state taxpayers. State appropriations per student are much lower than they were a decade ago; actually, about 25 percent lower after adjusting for inflation. So colleges have to make up that lost revenue, and that happens through higher tuition levels.

It’s also important to note about two-thirds of students get some financial aid to help them pay tuition. The average net price students pay, after taking financial aid into consideration, has gone up much more slowly than published tuition rates. Those published sticker prices may be scary, but many students just don’t pay them.

2. What impact have rising tuition fees had on student debts?

Again, net prices have gone up much more slowly than sticker prices. So while it is certainly true that many students are paying more because of higher prices, that’s far from the whole story of rising student debt.

On average, grant aid is generous enough to cover all of tuition and fees for low-income students at public two-year and four-year colleges. But they still have to live while they are in school. So they are actually borrowing to cover those living costs — over which colleges have minimal control — rather than to pay tuition. The biggest cost of going to college for most students is actually forgone earnings, not tuition.

Families have lost both income and savings in recent years. So they are less able to pay for college out of past and current income and have to rely more on borrowing. That would be the case even if the price of tuition had not gone up at all.

A generation ago, only people whose parents could afford to pay went to college. They had much less need to borrow than the wider range of students who now go to college.

The percentage of students enrolling in the for-profit sector has increased dramatically over the past decade. Students in this sector almost all borrow, and they borrow significantly more than students in similar programs at public colleges and universities. This has also put upward pressure on average debt levels.

Most students borrow reasonable amounts and repay without too much difficulty — although they would rather not have this obligation. The federal government has an Income-Based Repayment Plan that assures no one has to pay more than they can afford on their federal loans.

3. Along the same lines, what impact do these tuition fees have on the value students — especially non-traditional students — place in pursuing a higher education credential?

Students and families clearly still value a college education. They understand some postsecondary education is necessary for most jobs with a bright future. Unfortunately, not all of the choices of programs and institutions available to students are promising ones. Students need much more information and support to make decisions about where and what to study and about how to finance their education.

If they had the guidance, there would be many fewer people making investments that don’t pay off. On average, postsecondary education is about the highest return investment people can make.

Author Perspective: Association