Published on

A Brief Introduction to Some Initial Research into the Online Program Management Industry

One of the evil words in higher education is profit, yet higher education increasingly uses outsourcing solutions for key services. This dichotomy of mistrust and reliance has created an uneven tension in the higher education space. One service that has been increasingly outsourced is online program development for higher education institutions. This reliance has led to the growth of the Online Program Management (OPM) industry.

OPMs are companies that have traditionally provided marketing and enrollment services but in recent years have added additional services such as instructional design and academic coaching. Holon IQ, a company that studies ed tech in higher education has estimated the value of the OPM industry at upwards of 7 billion dollars by 2025 (Holon IQ, 2022). Because of the secrecy related to OPMs, as well as the lack of understanding of what an OPM is, there is no real known number of OPM partnerships in the US. Estimates vary on the number but, on the high end, there are potentially 500 discrete partnerships with higher education.

Two primary economic models that comprise the OPM space: fee-for-service and revenue share OPMS. In the revenue share model, OPMs provide marketing and enrollment (as well as other) services for a fee. The revenue share OPMs are generally thought to spend hundreds of thousands or potentially millions of dollars in marketing to help generate enrollment. In exchange, the OPM receives a significant portion (often 40–50%) of the tuition for each student enrolled in the OPM program. Fee-for-service OPMs work exactly as the name indicates: Institutions pay the OPM provider for specific services related to online operations. Fee-for-service is a newer type of OPM developed from the belief that the revenue share OPMs don’t function in the best interest of higher education institutions.

Being such a significant part of the higher education space, the secrecy that surrounds revenue share OPM contracts has been troubling. OPMs have provided little transparency, and higher education scholars have done little research into the industry scholars. This is concerning because without this research there is no clear picture of whether the money being spent by higher education institutions in terms of lost tuition revenue is potentially being wasted.

While the OPMs in recent years have opened up slightly and begun to engage in at least surface-level transparency (see 2U’s Framework for Transparency), they have continued to refuse to allow for the kind of academic scrutiny that would enable a greater understanding of how well or how poorly OPMs impact higher education. This lack of transparency has led to continued suspicion and with that suspicion increased scrutiny from the general public (see Kevin Carey’s Creeping Capitalist Takeover of Higher Education), progressive watchdog organizations such as the Century Foundation and federal regulation. Led by Senators Elizabeth Warren, Sherrod Brown and others, the federal government has repeatedly requested for data from the leading OPMs, and both the Government Accountability Office and the Department of Education are scrutinizing the OPM industry. Up to this point, the only data review has been a limited scope review of OPM contracts. The result of this scrutiny is to paint a picture that highlights the millions paid to the OPMs in the agreement and the length of the contracts, which are often five to seven years long. This picture often shows OPMs in a light akin to vultures, but it is not an accurate reflection of the relationship between OPMs and higher education.

Recently, academic engagement in the study of OPMs is growing. A number of research organizations have begun to publish data related to OPMs. Furthermore, researchers from the University of Louisville and UPCEA have partnered to begin studying the OPM phenomenon. The work I have conducted and continued to be interested in revolves around how institutions feel about the OPMs they partner with, and it is some of the first work of its kind in the United States. Primarily, the research focuses on institutional satisfaction of higher education institutions with their OPM partners and is grounded in the theoretical framework of Oliver’s expectation confirmation theory (ECT).

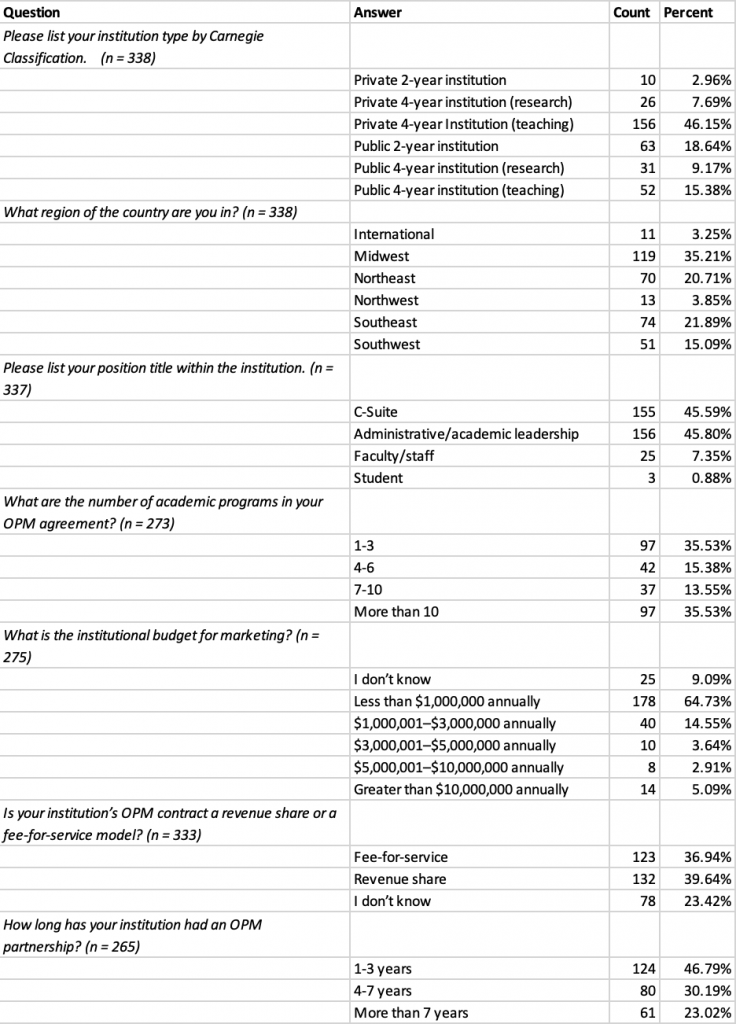

Table 1 is a breakdown of the survey respondents:

This is only a brief introduction to the research into the OPM phenomenon. While the work looks at how institutions view their OPM’s performance, it does not analyze the efficacy of the OPM’s performance in terms of marketing, enrollment or any other service. Further studies that address OPM performance are needed. More importantly, because one of the main criticisms of OPMs is that they recruit students who are not “up to par,” research should be conducted to see how well students recruited by OPMs perform academically. This research should be conducted, not to prevent students from enrolling but to identify areas where these students receive additional support to succeed. This article only scratches the surface of the OPM phenomenon. Hopefully, additional research will be conducted to provide transparency into the industry and its impact on higher education. If you would like to read additional information related to my research, please feel free to visit National Louis University’s Digital Commons at https://digitalcommons.nl.edu/diss/610.

References

Graham, M., “Institutional Satisfaction with Online Program Management (OPM) Providers” (2021). Dissertations. 610. https://digitalcommons.nl.edu/diss/610.

The anatomy of an OPM and a $7.7B market in 2025. HolonIQ. Global Impact Intelligence. (n.d.). Retrieved September 28, 2022, from https://www.holoniq.com/notes/the-anatomy-of-an-opm-and-a-7-7b-market-in-2025

Author Perspective: Administrator